Are you looking for an answer to the topic “What is FIFO method with example?“? We answer all your questions at the website Ecurrencythailand.com in category: +15 Marketing Blog Post Ideas And Topics For You. You will find the answer right below.

Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.The FIFO method requires that what comes in first goes out first. For example, if a batch of 1,000 items gets manufactured in the first week of a month, and another batch of 1,000 in the second week, then the batch produced first gets sold first. The logic behind the FIFO method is to avoid obsolescence of inventory.To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is FIFO method explain it with a example?

The FIFO method requires that what comes in first goes out first. For example, if a batch of 1,000 items gets manufactured in the first week of a month, and another batch of 1,000 in the second week, then the batch produced first gets sold first. The logic behind the FIFO method is to avoid obsolescence of inventory.

What is FIFO method formula?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

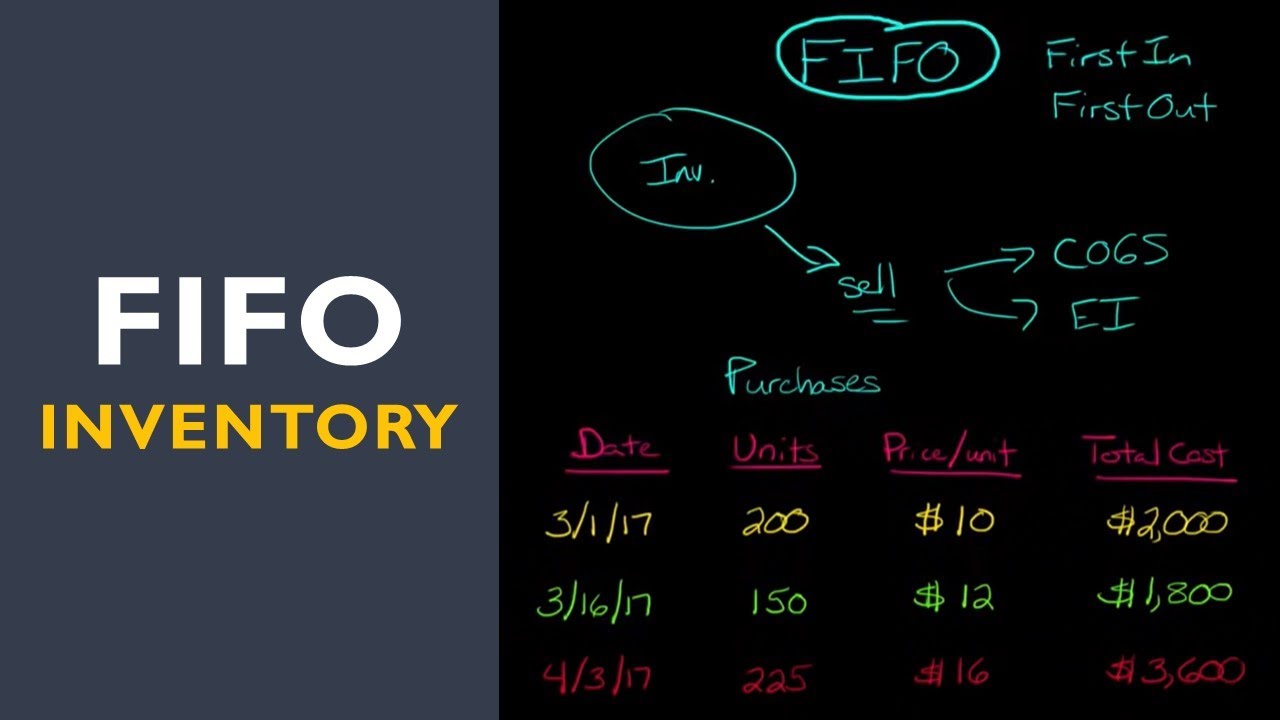

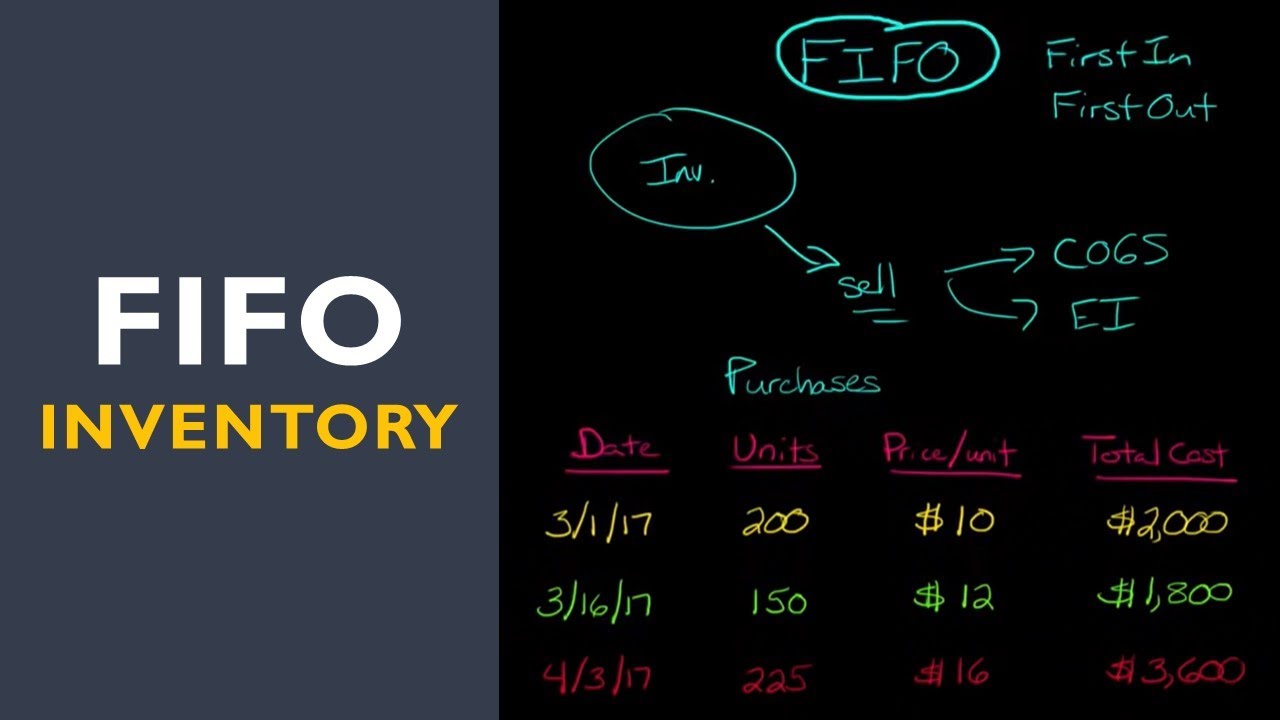

FIFO Inventory Method

Images related to the topicFIFO Inventory Method

What is LIFO and FIFO with example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.

What is an example of LIFO?

Based on the LIFO method, the last inventory in is the first inventory sold. This means the widgets that cost $200 sold first. The company then sold two more of the $100 widgets. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100.

What is LIFO method?

LIFO stands for “Last-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation.

What is the importance of FIFO?

FIFO helps food establishments cycle through their stock, keeping food fresher. This constant rotation helps prevent mold and pathogen growth. When employees monitor the time food spends in storage, they improve the safety and freshness of food. FIFO can help restaurants track how quickly their food stock is used.

Who uses FIFO inventory method?

Companies that sell perishable products or units subject to obsolescence, such as food products or designer fashions, commonly follow the FIFO method of inventory valuation.

See some more details on the topic What is FIFO method with example? here:

What Is FIFO Method: Definition and Example – FreshBooks

FIFO stands for “First-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation.

First-In First-Out Inventory Method | Definition, Example

First-In, First-Out (FIFO) is one of the methods commonly used to estimate the value of inventory on hand at the end of an accounting period …

First in, first out method (FIFO) definition – AccountingTools

The first in, first out (FIFO) method of inventory valuation is a cost flow assumption that the first goods purchased are also the first …

FIFO – Guide to First-In First-Out Inventory Accounting Method

For example, consider the same example above with two snowmobiles at a unit cost of $50,000 and a new purchase for a snowmobile for $75,000. The sale of one …

FIFO Method (First In First Out) Store Ledger Account- Problem – BCOM / BBA – By Saheb Academy

Images related to the topicFIFO Method (First In First Out) Store Ledger Account- Problem – BCOM / BBA – By Saheb Academy

Where is LIFO used?

The U.S. is the only country that allows LIFO because it adheres to Generally Accepted Accounting Principles (GAAP), rather than the International Financial Reporting Standards (IFRS), the accounting rules followed in the European Union (EU), Japan, Russia, Canada, India, and many other countries.

What is Fefo and FIFO?

FEFO / FIFO is a technique for managing loads that aims to supply products (to make them flow through the supply chain) by selecting those closest to expiration first (First Expired, First Out), and when the expiration is the same, the oldest first (First In, First Out).

What are the advantages of FIFO and LIFO?

During periods of inflation, FIFO maximizes profits as older, cheaper inventory is used as cost of goods sold; in contrast, LIFO maximizes profits during periods of deflation. Some companies focus on minimizing taxes by picking the method with the smallest profit.

What is the FIFO method of food storage?

FIFO is “first in first out” and simply means you need to label your food with the dates you store them, and put the older foods in front or on top so that you use them first. This system allows you to find your food quicker and use them more efficiently.

What are the 5 benefits of FIFO first in first out?

- Increased Warehouse Space. Goods can be packed more compactly to free up extra floor space in the warehouse.

- Warehouse Operations are More Streamlined. …

- Keeps Stock Handling to a Minimum. …

- Enhanced Quality Control. …

- Warranty Control.

How to Calculate FIFO Inventory (The Easy Way)

Images related to the topicHow to Calculate FIFO Inventory (The Easy Way)

How do you implement FIFO?

- Carton Flow picking system:

- High-density live storage system for boxes and light products. The product moves along rollers from the loading to the unloading area.

How is FIFO depth calculated?

Example : FIFO Depth Calculation

If if we have alternate read cycles i.e between two read cycle there is IDLE cycle. If 10 IDLE cycles betweeen two read cycles . FIFO DEPTH = B – B *F2/(F1*10) .

Related searches to What is FIFO method with example?

- LIFO method

- disadvantage of fifo

- what is fifo method with example

- FIFO method example

- what is fifo method used for

- lifo method

- in fifo method of inventory valuation

- Fifo method là gì

- fifo method la gi

- weighted average method

- which uses fifo method

- Ending inventory FIFO

- fifo formula

- fifo method example

- Weighted average method

- what is fifo method explain with example

- FIFO formula

- ending inventory fifo

Information related to the topic What is FIFO method with example?

Here are the search results of the thread What is FIFO method with example? from Bing. You can read more if you want.

You have just come across an article on the topic What is FIFO method with example?. If you found this article useful, please share it. Thank you very much.