Are you looking for an answer to the topic “What is the 2021 standard deduction?“? We answer all your questions at the website Ecurrencythailand.com in category: +15 Marketing Blog Post Ideas And Topics For You. You will find the answer right below.

For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. They also both get an additional standard deduction of $1,350 for being over age 65. They get one more additional standard deduction because Susan is blind.Standard Deduction

$12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.Couples in which one or both spouses are age 65 or older also get bigger standard deductions than younger taxpayers. If only one spouse is 65 or older, the extra amount for 2021 is $1,350 – $2,700 if both spouses are 65 or older ($1,400 and $2,800, respectively, for 2022). Be sure to take advantage of your age!

| Filing Status | 2021 Standard Deduction |

|---|---|

| Single; Married Filing Separately | $12,550 |

| Married Filing Jointly | $25,100 |

| Head of Household | $18,800 |

What is the standard deduction for over 65 in 2021?

For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. They also both get an additional standard deduction of $1,350 for being over age 65. They get one more additional standard deduction because Susan is blind.

What is the standard deduction amount for 2021 taxes?

Standard Deduction

$12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.

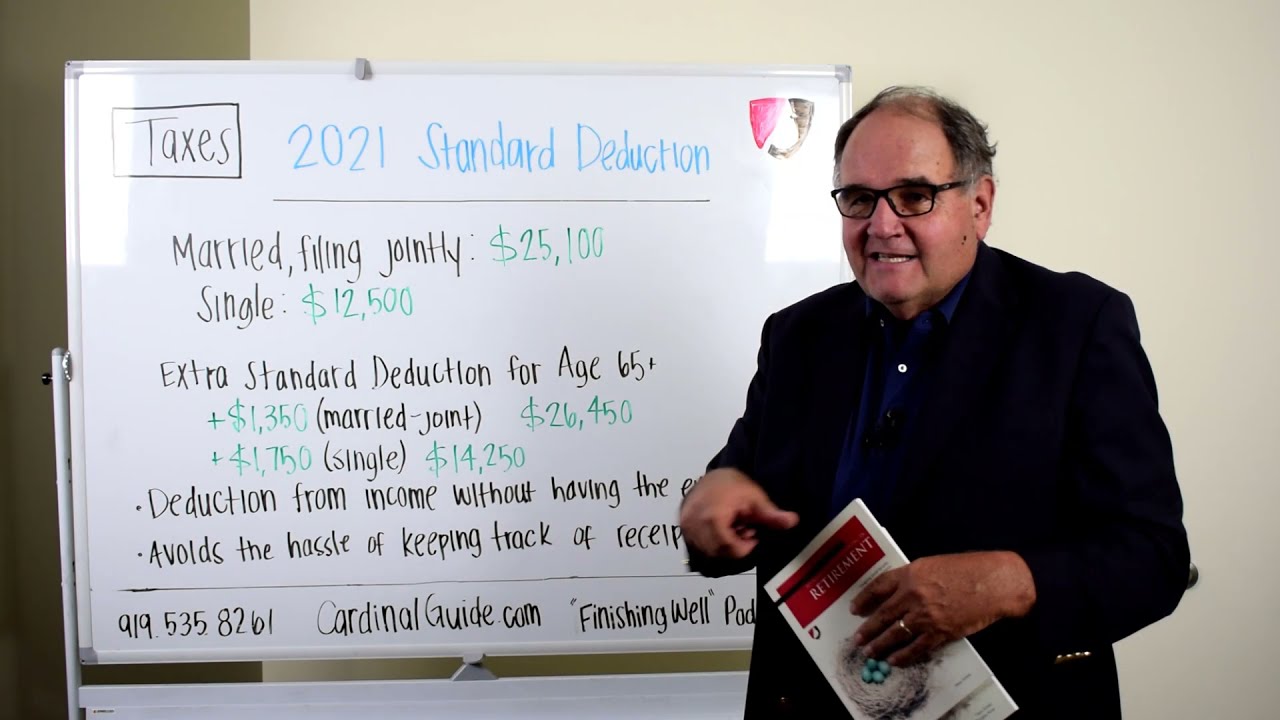

Standard Tax Deduction 2021

Images related to the topicStandard Tax Deduction 2021

What is the extra standard deduction for seniors over 65?

Couples in which one or both spouses are age 65 or older also get bigger standard deductions than younger taxpayers. If only one spouse is 65 or older, the extra amount for 2021 is $1,350 – $2,700 if both spouses are 65 or older ($1,400 and $2,800, respectively, for 2022). Be sure to take advantage of your age!

Did the standard deduction change for 2021?

The standard deduction is higher

For your 2021 tax return, the standard deduction is now $12,550 for single filers (an increase of $150) and $25,100 for married couples filing jointly (an increase of $300). For heads of households, the standard deduction is now $18,800 (an increase of $150).

Do senior citizens get a higher standard deduction?

Increased Standard Deduction

When you’re over 65, the standard deduction increases. The specific amount depends on your filing status and changes each year. For the 2021 tax year, seniors get a tax deduction of $14,250 (this increases in 2022 to $14,700).

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

See some more details on the topic What is the 2021 standard deduction? here:

2021 and 2022 Tax Brackets and Other Tax Changes

2021 Standard Deductions · $12,550 for single filers · $12,550 for married couples filing separately · $18,800 for heads of households …

Standard Deduction 2021-2022: How Much It Is – NerdWallet

The 2021 standard deduction is $12,550 for single filers, $25,100 for joint filers or $18,800 for heads of household. Written by NerdWallet.

IRS provides tax inflation adjustments for tax year 2021

The standard deduction for married couples filing jointly for tax year 2021 rises to $25,100, up $300 from the prior year.

The 2021-2022 Standard Deduction: Should You Take It?

What is the standard deduction for 2021? · $12,550 for single filers · $12,550 for married taxpayers filing separately · $18,800 for heads of …

How do I claim 50000 standard deduction?

Standard deduction is available upto Rs 50,000 in a financial year. However, you can claim this deduction only once. For example, if you have worked with two employers during the year, your standard deduction will be limited to Rs 50,000 and is a standard deduction available only on salaried income.

What is the tax allowance for 2021 2022?

The amount is the same in all four UK countries. Chancellor Sunak announced that the Personal Allowance for the 2021-2022 tax year is £12,570. That’s applicable from 6th April 2021. You can earn up to £12,570 and not pay any income tax to HMRC.

Is Social Security taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

How much can a retired person earn without paying taxes in 2021?

In 2021, the income limit is $18,960. During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2021, the limit is $50,520 before the month the worker reaches full retirement age.

How much can a 70 year old earn without paying taxes?

For retirees 65 and older, here’s when you can stop filing taxes: Single retirees who earn less than $14,250. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older.

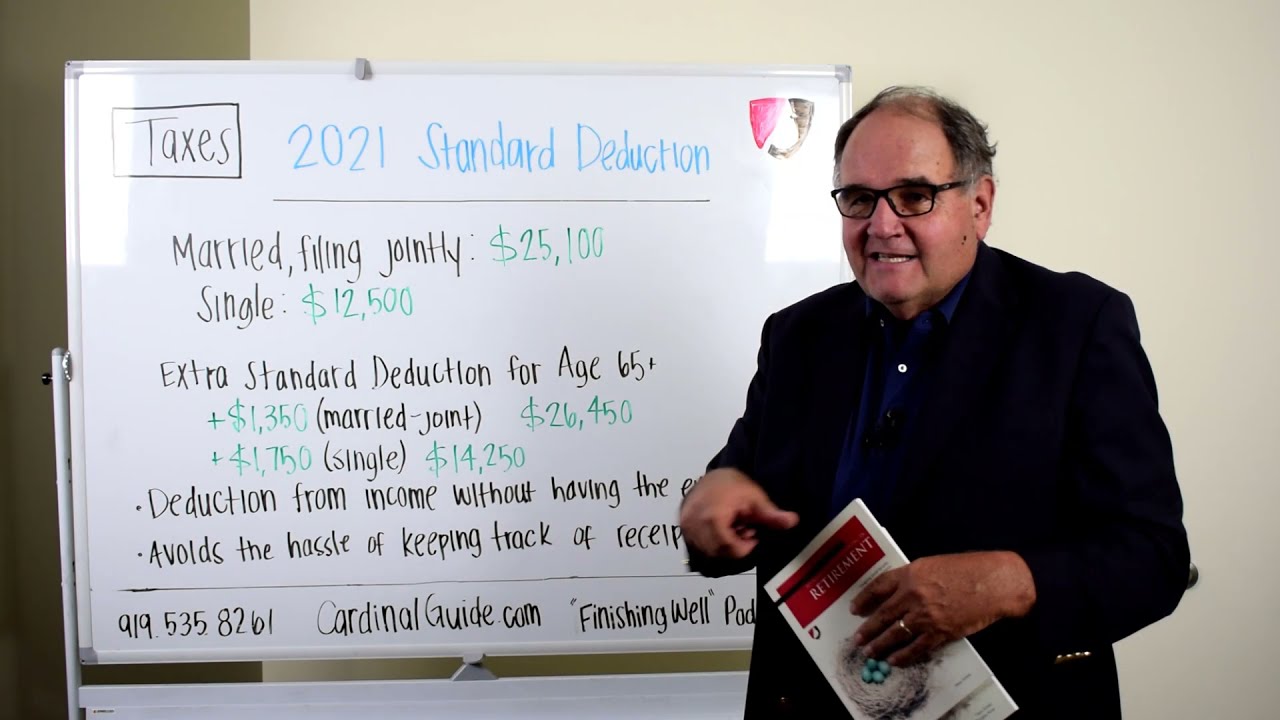

Standard Deduction Explained (So That ANYONE Can Understand!)

Images related to the topicStandard Deduction Explained (So That ANYONE Can Understand!)

What are the changes for 2021 taxes?

- Higher standard deductions. …

- Tax bracket adjustments. …

- Increased child tax credits. …

- Higher Earned Income Credit. …

- Some student loan forgiveness is tax-free. …

- Charitable donations. …

- Unemployment benefits are taxable again. …

- Stimulus checks.

What are the new taxes for 2021?

Standard Deduction

That’s a $300 increase over the 2020 tax year amount. For each spouse 65 years of age or older, you can tack on an additional $1,350 ($1,300 for 2020). Single filers can claim a $12,550 standard deduction on their 2021 tax return ($12,400 for 2020).

What are the tax exemptions for 2021?

…

- What is income tax slab ? …

- Income Tax Slab Rates for FY 2021-22 (AY 2022-23 ) …

- Income Tax Slab Rates for FY 20-21.

Are health insurance premiums tax-deductible in 2021?

Is health insurance tax-deductible? Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes.

What is the 2022 standard deduction for seniors?

Taxpayers who are at least 65 years old or blind will be able to claim an additional 2022 standard deduction of $1,400 ($1,750 if using the single or head of household filing status). If you’re both 65 and blind, the additional deduction amount will be doubled.

Is Social Security considered gross income?

Since the 1980s, some recipients of these benefits who meet certain income levels have been required to pay taxes on the money they receive. While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

When a husband dies does the wife get his Social Security?

Widow or widower, full retirement age or older — 100% of the deceased worker’s benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker’s basic amount. Widow or widower with a disability aged 50 through 59 — 71½%.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Do I have to pay taxes on Social Security after age 66?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

What Is The Standard Deduction for 2021?

Images related to the topicWhat Is The Standard Deduction for 2021?

Are pensions taxable income?

Pensions. Most pensions are funded with pretax income, and that means the full amount of your pension income would be taxable when you receive the funds. Payments from private and government pensions are usually taxable at your ordinary income rate, assuming you made no after-tax contributions to the plan.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

Related searches to What is the 2021 standard deduction?

- standard deduction 2021 single

- what is the california standard deduction for 2021

- tax tables 2021

- 2021 standard deduction over 65

- 2021 tax deductions

- what is the 2021 standard deduction for married filing jointly

- what is the federal standard deduction for 2021

- what is the standard federal tax deduction for 2021

- what is the standard deduction for ay 2021 22

- what is the 2021 standard deduction for over 65

- what is the 2021 standard deduction for married filing jointly over 65

- standard deduction 2020

- what is the 2021 standard deduction for seniors

- standard deduction 2021 married filing jointly

- itemized deductions 2021

- what is the 2021 standard deduction

- what is the standard tax deduction for 2021

- 2022 standard deduction over 65

Information related to the topic What is the 2021 standard deduction?

Here are the search results of the thread What is the 2021 standard deduction? from Bing. You can read more if you want.

You have just come across an article on the topic What is the 2021 standard deduction?. If you found this article useful, please share it. Thank you very much.