Are you looking for an answer to the topic “What is the EMI for 1 lakh personal loan?“? We answer all your questions at the website Ecurrencythailand.com in category: +15 Marketing Blog Post Ideas And Topics For You. You will find the answer right below.

6) Attractive Interest Rates

Apply today to enjoy a Rs 1 lakh personal loan EMI as low as Rs 2,275 for a loan tenure of 60 months.✅What is the lowest EMI per lakh offered by SBI on a personal loan? SBI offers a personal loan at a 9.60% interest rate for a maximum of 72 months, and hence lowest EMI per lakh loan amount is ₹ 1,832.

| Loan Tenure | 2 years | 3 years |

|---|---|---|

| EMI amount for loan amount ₹ 1 Lakh at 10.25% | ₹ 4,626 | ₹ 3,238 |

| Total amount you pay back to the bank including principal and interest | ₹ 1.22 Lakh | ₹ 1.35 Lakh |

| Interest you have to pay over loan tenure | ₹ 22,436 | ₹ 35,476 |

| Loan Amount | Rate of Interest | Per Month EMI |

|---|---|---|

| 2 lakh | 15.00% | Rs. 6,933 |

| 2 lakh | 16.00% | Rs. 7,031 |

| 2 lakh | 18.00% | Rs. 7,230 |

| 2 lakh | 20.00% | Rs. 7,433 |

| Loan Amount | Rate of Interest | Per Month EMI |

|---|---|---|

| 3 Lakh | 14.00% | Rs.10253.29 |

| 3 Lakh | 15.00% | Rs.10399.6 |

| 3 Lakh | 16.00% | Rs.10547.11 |

| 3 Lakh | 18.00% | Rs.10845.72 |

What is the EMI of 1lakh personal loan?

6) Attractive Interest Rates

Apply today to enjoy a Rs 1 lakh personal loan EMI as low as Rs 2,275 for a loan tenure of 60 months.

What is the EMI for 2 lakhs personal loan?

| Loan Amount | Rate of Interest | Per Month EMI |

|---|---|---|

| 2 lakh | 15.00% | Rs. 6,933 |

| 2 lakh | 16.00% | Rs. 7,031 |

| 2 lakh | 18.00% | Rs. 7,230 |

| 2 lakh | 20.00% | Rs. 7,433 |

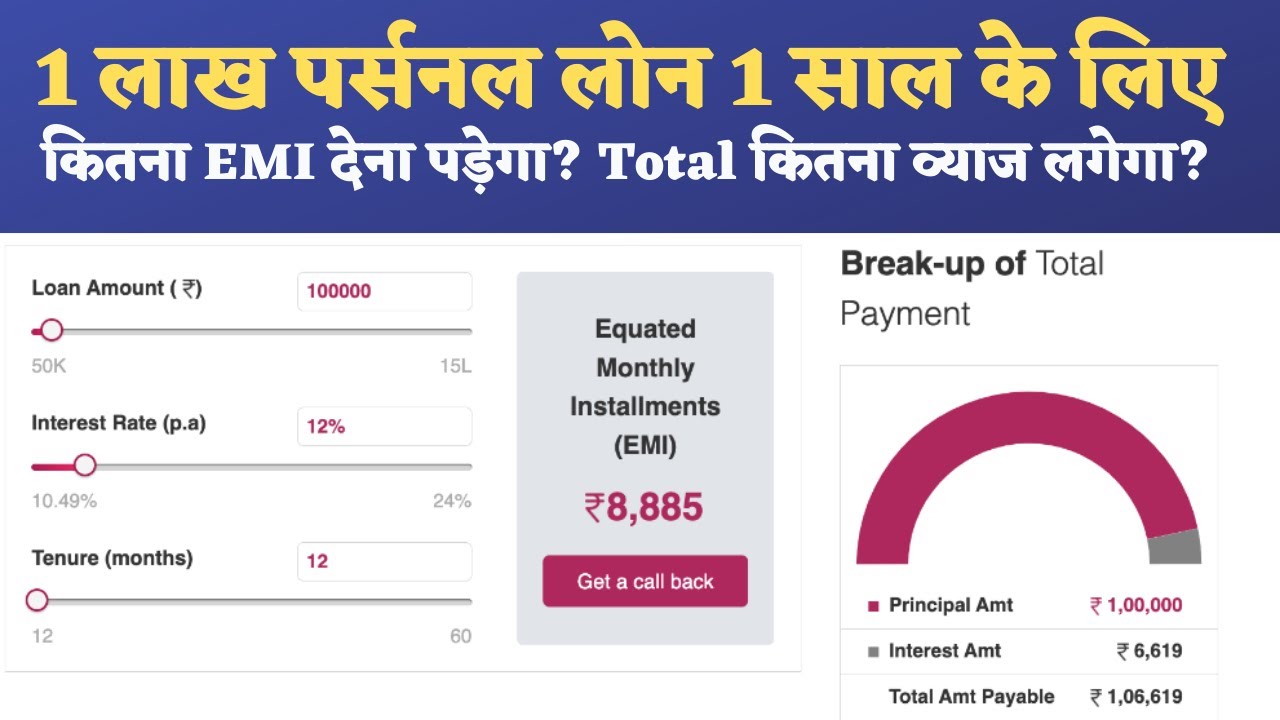

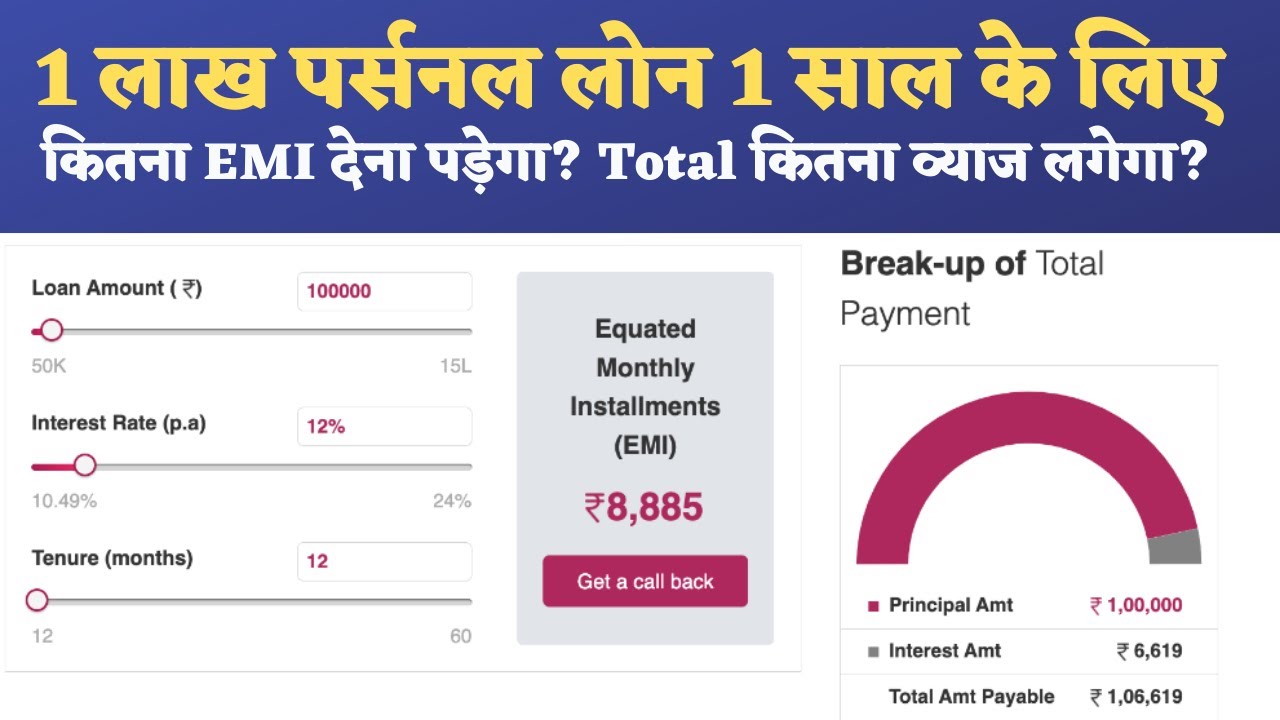

1 Lakh Personal Loan for 1 Year – Personal Loan EMI Calculator – Personal Loan Interest Rates 2022

Images related to the topic1 Lakh Personal Loan for 1 Year – Personal Loan EMI Calculator – Personal Loan Interest Rates 2022

What is the interest of 1 lakh in SBI personal loan?

✅What is the lowest EMI per lakh offered by SBI on a personal loan? SBI offers a personal loan at a 9.60% interest rate for a maximum of 72 months, and hence lowest EMI per lakh loan amount is ₹ 1,832.

What is the EMI for 3 lakhs personal loan?

| Loan Amount | Rate of Interest | Per Month EMI |

|---|---|---|

| 3 Lakh | 14.00% | Rs.10253.29 |

| 3 Lakh | 15.00% | Rs.10399.6 |

| 3 Lakh | 16.00% | Rs.10547.11 |

| 3 Lakh | 18.00% | Rs.10845.72 |

What is the interest of 1 lakh?

…

Monthly Payout.

| Investment amount | Monthly interest | Cumulative interest for 5 years |

|---|---|---|

| 1 lakh | Rs. 526 | Rs. 37,009 |

| 5 lakh | Rs.2,629 | Rs. 185,043 |

| 10 lakh | Rs.5,258 | Rs.3,70,087 |

| 15 lakh | Rs. 7,887 | Rs.5,55,130 |

How can I get 1 lakh loan fast?

- Check your eligibility. Visit the Money View website or loan app. …

- Choose your loan plan. Based on the options provided, select the loan amount and repayment term of your choice.

- Upload required documents. …

- Loan transfer to your bank account.

What is the interest of 1 lakh in muthoot?

…

11. Muthoot Premier Loan (MPL)

| Minimum Loan Amount | Rs.1 lakh |

|---|---|

| Maximum Loan Amount | No limit |

| Rate of Interest | 23% p.a. |

See some more details on the topic What is the EMI for 1 lakh personal loan? here:

Personal Loan of Rs. 1 Lakh – Calculate Your EMI & Apply …

Apply today to enjoy a Rs 1 lakh personal loan EMI as low as Rs 2,275 for a loan tenure of 60 months. 7) No Hidden Charges. Fullerton India doesn’t charge any …

Rs.1 lakh Personal loan for 3 Years | EMI Details | Interest Rates

1 Lakh Personal Loan Interest Rates 2022 ; HDFC Bank, 10.99 – 20.75% ; ICICI Bank, 11.70 – 18.85% ; Bajaj Finserv, 11.99 – 16.00% ; Fullerton India, 14.00 – 33.00%.

Personal Loan EMI Calculator – Axis Bank

Flexibility of amount and time: You can get a personal loan for amounts ranging from Rs. 50,000 to Rs 15 lakh for any period between 12 and 60 months.

Get 1 Lakh Personal Loan – HDFC Bank

You can also choose a suitable loan tenure for your Rs 1 lakh Personal Loan, and repay the amount in pocket-friendly equated monthly installments (EMIs). You …

How much loan can I get on my salary of 15000?

If you are a salaried individual, then you can be eligible to get a housing loan up to 60x your net monthly income as a rule of thumb. So, if your net monthly salary is Rs. 15,000, you can get a home loan up to approximately Rs. 9,00,000.

How much loan can I get if my salary is 10000?

…

Personal Loan For Low Salary Less Than 10000.

| Bank | Minimum Monthly Income Required |

|---|---|

| Punjab National Bank | Rs. 10,000 |

| HDFC Bank | Rs. 15,000 |

| ICICI Bank | Rs. 17,500 |

How is EMI calculated?

The mathematical formula to calculate EMI is: EMI = P × r × (1 + r)n/((1 + r)n – 1) where P= Loan amount, r= interest rate, n=tenure in number of months.

Which bank has lowest interest rate for personal loan?

| Bank | Interest Rates | Lowest EMI Per Lakh |

|---|---|---|

| HDFC Bank Personal Loan ⊕ Compare | 10.25% | ₹ 2,137 |

| ICICI Bank Personal Loan ⊕ Compare | 10.25% | ₹ 2,137 |

| Bajaj Finserv Personal Loan ⊕ Compare | 12.99% | ₹ 2,275 |

| IDFC First Bank Personal Loan ⊕ Compare | 10.49% | ₹ 2,149 |

How much personal loan can I get if my salary is 40000?

How much personal loan can I get on a ₹40000 salary? According to the Multiplier method, on a salary of ₹40000, you will be eligible for ₹13.50 lakhs for 5 years. Going by the Fixed Obligation Income Ratio method, if you have monthly EMIs of ₹3000, you will be eligible for an amount of ₹8.80 lakhs.

EMI Calculation – Excel Formula Expert EMI Calculator [Hindi]

Images related to the topicEMI Calculation – Excel Formula Expert EMI Calculator [Hindi]

![Emi Calculation - Excel Formula Expert Emi Calculator [Hindi]](https://i.ytimg.com/vi/yycBGSH8BxU/maxresdefault.jpg)

How is Lac EMI calculated?

USING MATHEMATICAL FORMULA

EMI = [P x R x (1+R)^N]/[(1+R)^N-1], where P stands for the loan amount or principal, R is the interest rate per month [if the interest rate per annum is 11%, then the rate of interest will be 11/(12 x 100)], and N is the number of monthly instalments.

How much loan can I get on 30000 salary?

| Salary | Expected Personal Loan Amount |

|---|---|

| Rs. 20,000 | Rs. 5.40 lakhs |

| Rs. 30,000 | Rs. 8.10 lakhs |

| Rs. 40,000 | Rs. 10.80 lakhs |

| Rs. 50,000 | Rs. 13.50 lakhs |

How much loan can I get if my salary is 25000?

Most lenders determine the maximum loan amount up to 10 times of your monthly salary. If you earn Rs. 25,000 per month, you may become eligible for up to Rs. 2.5 Lakhs.

What is the interest of 2 lakh in SBI?

| Investment Amount | For 3 years with interest of 5.45% | For 5 years with interest of 5.5% |

|---|---|---|

| ₹ 1 lakh | ₹117719 | ₹131570 |

| ₹ 2 lakh | ₹235438 | ₹263141 |

| ₹ 5 lakh | ₹588595 | ₹657852 |

| ₹ 10 lakh | ₹1177190 | ₹1315704 |

What is the monthly interest on 1 lakh in HDFC?

| Tenor | Interest Rates of FD | ₹ 1 Lakh Fixed Deposit Interest Per Month |

|---|---|---|

| Non-Senior Citizen | Non-Senior Citizen | |

| 1 Year | 4.90% | ₹416 |

| 2 Years | 4.90% | ₹426 |

| 3 Year | 5.15% | ₹461 |

What is SBI interest rate?

| Tenure | General Public FD Rate | Senior Citizens FD Rate |

|---|---|---|

| 46 – 179 days | 3.90% | 4.40% |

| 180 – upto 1 yr | 4.40% | 4.90% |

| 1 yr – upto 2 yrs | 5.10% | 5.60% |

| 2 yrs – upto 3 yrs | 5.20% | 5.70% |

What is the minimum salary to get personal loan?

When it comes to personal loans, there is no set minimum salary for your application to be approved. Some banks may keep a minimum limit (say Rs. 15,000 – Rs. 20,000 per month).

How can I earn 1 lakh in a day?

…

However, you must remember that you’ll not start making huge money as soon as you start.

- Freelancing.

- Affiliate marketing.

- Starting your website.

- Surveys, reviews, and searches.

- Online tutoring.

- Language translating.

- Starting a YouTube channel, and many more.

Which is the best bank for personal loan in India?

| Banks/NBFCs | Interest Rates (per annum) | |

|---|---|---|

| SBI | 9.60% – 13.85% | Apply Now |

| HDFC Bank | 10.25% – 21% | Apply Now |

| ICICI Bank | 10.25% onwards | Apply Now |

| Axis Bank | 10.25% onwards | Apply Now |

Which is better gold loan or personal loan?

For instance, a gold loan can be a better choice if you can repay the loan in a shorter duration and have a lower interest rate. On the other hand, a personal loan would be better for a longer tenure & higher loan amount. You must thus compare both loans depending on the requirement of your financial needs.

Navi kreditbee Personal loan comparison | 1 lakh personal loan for 2 years | EMI calculator

Images related to the topicNavi kreditbee Personal loan comparison | 1 lakh personal loan for 2 years | EMI calculator

How do I calculate interest?

Here’s the simple interest formula: Interest = P x R x N. P = Principal amount (the beginning balance). R = Interest rate (usually per year, expressed as a decimal). N = Number of time periods (generally one-year time periods).

How do I calculate interest on a loan?

- Divide your interest rate by the number of payments you’ll make that year. …

- Multiply that number by your remaining loan balance to find out how much you’ll pay in interest that month. …

- Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.

Related searches to What is the EMI for 1 lakh personal loan?

- 1 lakh personal loan emi bajaj finance

- how emi is calculated for personal loan

- 5 lakh personal loan emi

- what is the emi for 5 lakh personal loan

- 1 lakh personal loan emi sbi

- what is the emi for 3 lakhs personal loan

- personal loan emi calculator

- what will be the emi for 1 lakh personal loan

- how to reduce emi amount in personal loan

- what is the emi for 1 lakh personal loan

- personal loan 1 lakh

- 1 lakh personal loan emi hdfc

- 10 lakh personal loan emi for 5 years

- 15 lakh personal loan emi for 5 years

- 1 lakh personal loan interest

Information related to the topic What is the EMI for 1 lakh personal loan?

Here are the search results of the thread What is the EMI for 1 lakh personal loan? from Bing. You can read more if you want.

You have just come across an article on the topic What is the EMI for 1 lakh personal loan?. If you found this article useful, please share it. Thank you very much.