Are you looking for an answer to the topic “When can you start charging interest on an invoice?“? We answer all your questions at the website Ecurrencythailand.com in category: +15 Marketing Blog Post Ideas And Topics For You. You will find the answer right below.

A vendor can charge interest on an unpaid invoice but should only do so when there is a contract or agreement in place that allows for it. Otherwise, there is no legal obligation for the client to pay the additional fee, and adding this charge may harm the business relationship and affect future work opportunities.Multiply the invoice amount times the yearly interest rate to determine the yearly interest charges. Divide this amount by the frequency of payment (monthly or daily) and then multiply that number times the number of days or months late.Yes, there is nothing stopping a vendor from charging interest on overdue invoices. The practice is legal. However, the real question is whether the clients are obligated to pay it. If a vendor doesn’t have an agreement with a client on the payment terms and late fee, then that means the client doesn’t have to pay it.

How do you charge interest on invoice?

Multiply the invoice amount times the yearly interest rate to determine the yearly interest charges. Divide this amount by the frequency of payment (monthly or daily) and then multiply that number times the number of days or months late.

Can I add interest to an unpaid invoice?

Yes, there is nothing stopping a vendor from charging interest on overdue invoices. The practice is legal. However, the real question is whether the clients are obligated to pay it. If a vendor doesn’t have an agreement with a client on the payment terms and late fee, then that means the client doesn’t have to pay it.

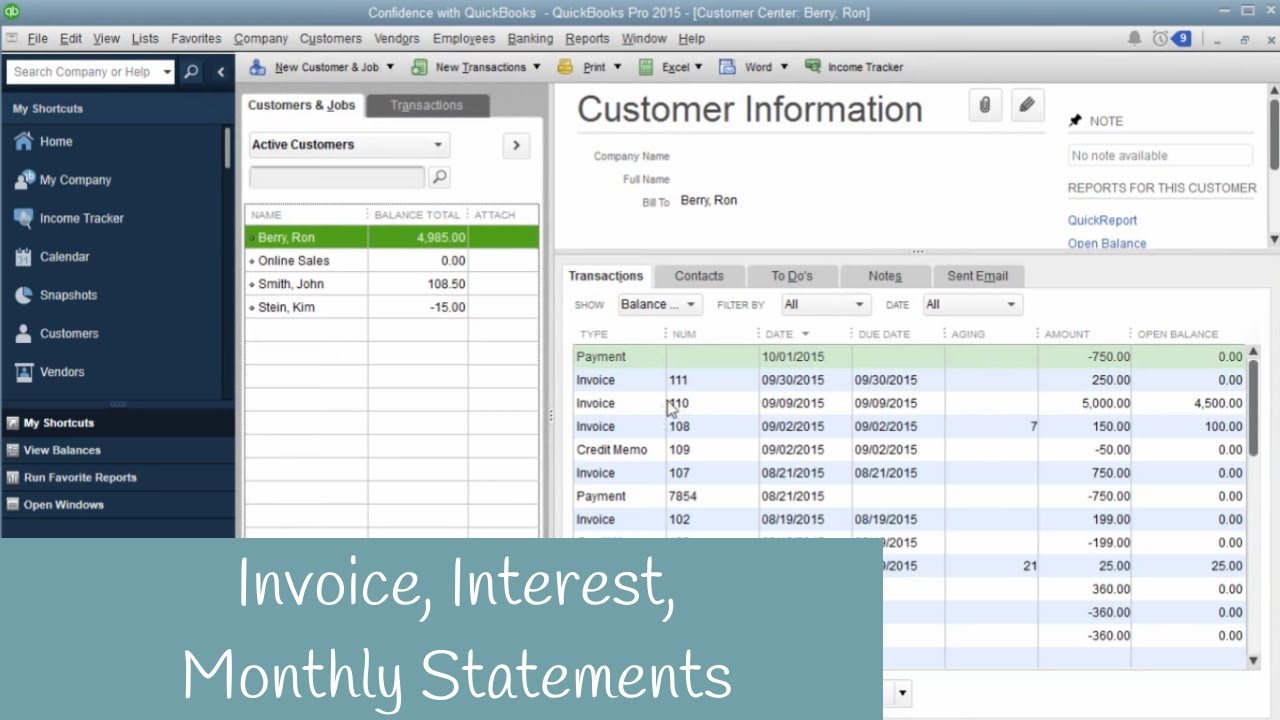

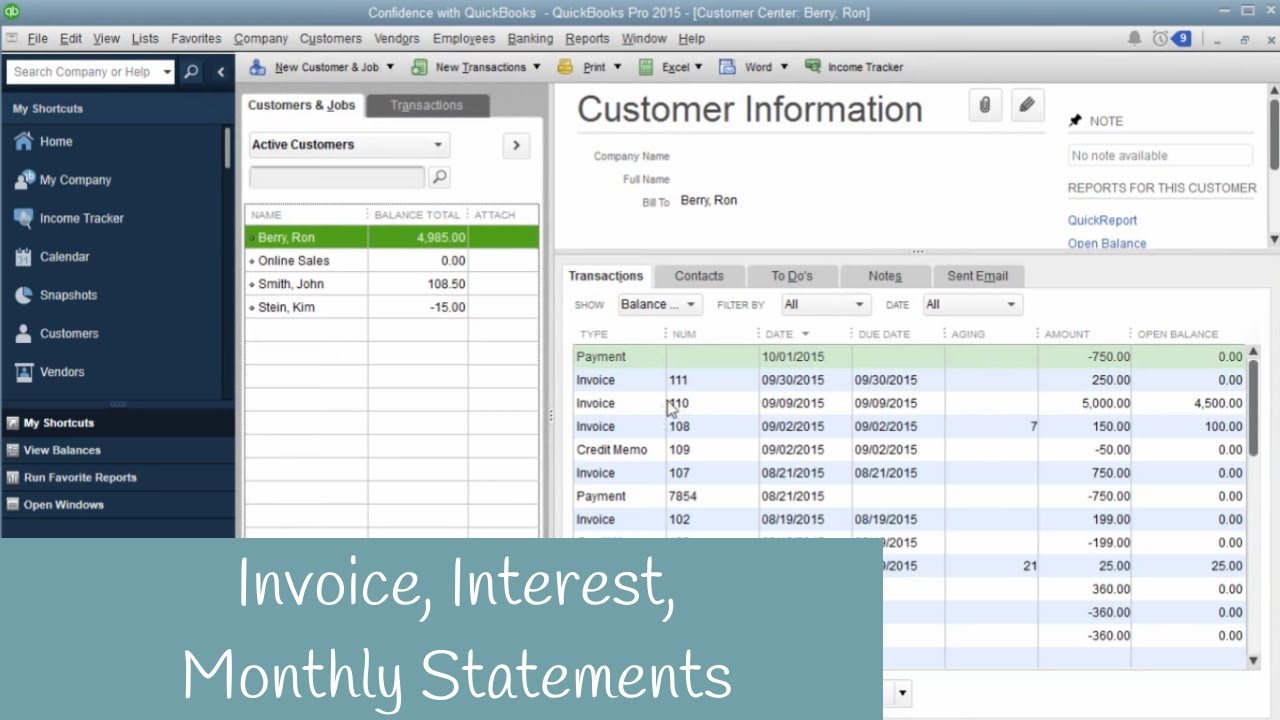

How to create a Invoice, Charge Interest, Monthly Statement in QuickBooks

Images related to the topicHow to create a Invoice, Charge Interest, Monthly Statement in QuickBooks

When can you start paying interest on late?

You cannot charge late payment interest until your invoice becomes overdue.

Can you charge interest if not in contract?

A supplier is not entitled to claim interest on its invoices unless there is a prior agreement with the customer to pay interest on overdue accounts at that rate.

How much interest can I charge on unpaid invoices?

The interest you can charge if another business is late paying for goods or a service is ‘statutory interest’ – this is 8% plus the Bank of England base rate for business to business transactions. You cannot claim statutory interest if there’s a different rate of interest in a contract.

What is an acceptable late fee for an invoice?

Business owners have the option to charge a flat rate or a monthly finance charge, usually a percentage of the overdue amount. Companies typically assess a 1% to 1.5% late fee.

Can I charge interest on a debt?

Interest is added to almost all debts, and extra charges are added to many debts if you don’t pay on time. Interest can be charged at the same amount or it may be ‘variable’ and change over time. However, your creditors can’t increase the rate of interest because you’ve missed payments.

See some more details on the topic When can you start charging interest on an invoice? here:

How Much Interest Can I Add to an Overdue Invoice? Late …

There is no standard interest rate charge for an overdue invoice. This charge, known as a “late fee”, is up to the vendor.

Applying Interest Rates to an Invoice – Small Business – Chron …

If you receive your payment 20 days late, you can only charge interest for those 20 days. Begin counting the late period on the day after the payment is due, …

Charging Interest and Late Fees on Unpaid Invoices

Don’t charge more than 10% interest per year. Some states restrict the amount you can charge in late fees, but you’re likely safe if you cap rates at 10%. Try …

How to Charge Interest on Unpaid Invoices | GoCardless

Find out how to collect unpaid invoices from customers with our guide. Plus, we explore how to charge interest on unpaid invoices and late payments.

What is the legal rate of interest?

CALIFORNIA: The legal rate of interest is 10% for consumers; the general usury limit for non-consumers is more than 5% greater than the Federal Reserve Bank of San Francisco’s rate.

How do you add interest to a payment?

Add-on interest is a method of calculating the interest to be paid on a loan by combining the total principal amount borrowed and the total interest due into a single figure, then multiplying that figure by the number of years to repayment. The total is then divided by the number of monthly payments to be made.

Invoices: What You NEED TO KNOW

Images related to the topicInvoices: What You NEED TO KNOW

Can small business charge interest late payments?

A vendor can charge interest on an unpaid invoice but should only do so when there is a contract or agreement in place that allows for it. Otherwise, there is no legal obligation for the client to pay the additional fee, and adding this charge may harm the business relationship and affect future work opportunities.

Should I charge interest on late payments?

Should I charge interest on a late payment? You can charge interest on all late payments. However, even if you indicate in your terms and conditions that you will charge interest on all late payments, it is up to you whether you actually do so or not.

Can you charge a late payment fee?

The Fluidly guide to late payment fees. Not every business owner knows that they have a legal right to charge late payment fees. The Late Payment of Commercial Debts 1988 Act was established to protect business owners against late and missed payments.

What is a finance charge on an invoice?

A finance charge is a fee that is charged as interest accrued on your customer’s account with your business. On your invoices, you’ll likely specify payment terms that outline a specified window to receive payment.

How do you calculate finance charges on overdue invoices?

Multiply the amount due by the daily rate. For example, if the customer owes $200, multiply 200 by 0.06 to get a daily finance charge of $1.20. If the customer pays 20 days late, charge $1.20 for 20 days, so the total would be $200 plus $24 in finance charges.

Can I charge interest on overdue invoices Ontario?

General application: under the regulations (subsection 5(1)), when an account is overdue or a payment is late, departments must charge interest compounded monthly at the average bank rate plus 3% from the due date to the day before the date that payment is received.

What is the highest late fee allowed by law?

The Late Fee Fairness Amendment Act regulates the late fees that landlords may charge tenants. The Act says: A landlord can only charge a tenant up to 5% of the rent as a late fee.

Can you charge interest retrospectively?

A retroactive interest rate increase is a common practice used in the credit card industry. The credit card company increases interest rates on purchases made on the credit card that occurred in the past.

How to Calculate Interest on Overdue Invoice based Payment?

Images related to the topicHow to Calculate Interest on Overdue Invoice based Payment?

Can you charge someone interest?

Yes, you should charge family members interest when you loan them money — here’s how much.

Can interest be charged on a disputed invoice?

It is possible to claim interest on overdue invoices even if you haven’t agreed a formal contract. However, the key thing about credit terms is to agree them up front before trading with any other business, to help you get paid more quickly and avoid misunderstandings.

Related searches to When can you start charging interest on an invoice?

- finance charge wording on invoice

- can i charge interest on money owed to me

- when can you start charging interest on an invoice in qbo

- how to calculate interest on overdue invoices in excel

- interest invoice template

- when can you start charging interest on an invoice in quickbooks online

- can contractors charge interest on late payments

- can you charge interest on interest

- overdue invoice interest calculator

- late payment interest charge letter

- when can you start charging interest on an invoice in quickbooks desktop

- when can you start charging interest on an invoice in quickbooks

- when can you start charging interest on an invoice on paypal

Information related to the topic When can you start charging interest on an invoice?

Here are the search results of the thread When can you start charging interest on an invoice? from Bing. You can read more if you want.

You have just come across an article on the topic When can you start charging interest on an invoice?. If you found this article useful, please share it. Thank you very much.